Donor-Advised Funds are an easy and tax-efficient way to support urgent causes like Reprieve US. Funds will reach us quickly, and we can use them to save lives.

If you’ve got a Donor-Advised Fund and would like to recommend a grant to a human rights charity, read on to find out more about how Donor-Advised Funds work and how your money could help Reprieve US.

What are Donor-Advised Funds?

A Donor-Advised Fund, also known as a DAF, is an investment account for the sole purpose of supporting charities you care most about. By making a contribution into a Donor-Advised Fund, you will be eligible for an immediate federal income tax deduction.

Tax benefits will depend on your individual circumstances, and we always recommend you consult an accountant or a tax advisor.

How do Donor-Advised Funds work?

Donor-Advised Funds work by investing your assets – cash, securities, stocks or even cryptocurrency – with a public charity like Fidelity Charitable, Schwab Charitable, Vanguard Charitable, or many others. These are known as ‘sponsoring organizations’.

After you have contributed, your funds will be invested for tax-free growth. Your sponsoring organization will have various options for investing your funds until you’re ready. This means the size of your donations can grow while you decide who to recommend grants to.

When you are ready, you can then recommend grants to any IRS-qualified public charity, to support the causes you care about. You can do this immediately, or over time while your funds continue to grow.

Recommending a grant to Reprieve US is easy. You will just need our Employment Identification Number (EIN). Our EIN is 72-1514282.

You can then decide how you would like us to use your funds by letting us know the ‘designation’ of your donation. You might choose to let us decide how to use your funds most effectively by leaving this blank or entering ‘where the need is greatest’. You may choose to support a specific area of our work, for example, our work to close Guantánamo or our work to end the death penalty.

Why use Donor-Advised Funds?

There are benefits to using Donor-Advised Funds for both donors and charities.

As a donor, when you make a contribution to your Donor-Advised Fund, you receive your tax deduction upfront, not when your funds are distributed. This is great if you know that you want to make donations to charities in the future, but you’re not yet sure who to. While you decide, your funds will also be invested, meaning you may have more to allocate to the causes you care about when you are ready.

Donor-Advised Funds also offer a quick option for mobilizing funds when there is an urgent need. As your Donor-Advised Fund has been allocated for charitable giving, you are just a few clicks away from making a recommendation. This means you can react quickly to urgent appeals, and charities like Reprieve US can receive support when we need it most.

Why you should recommend a Donor-Advised Fund grant to Reprieve US?

Reprieve is a legal action non-profit 501(c)(3) organization.

We support some of the most disenfranchised people in the world, where human rights have been abandoned and the rule of law cast aside.

By recommending a grant to Reprieve US from your Donor-Advised Fund, we can fight for those who need it most – people on death row, people held without charge or trial, people tortured and people targeted by illegal and lethal drone attacks.

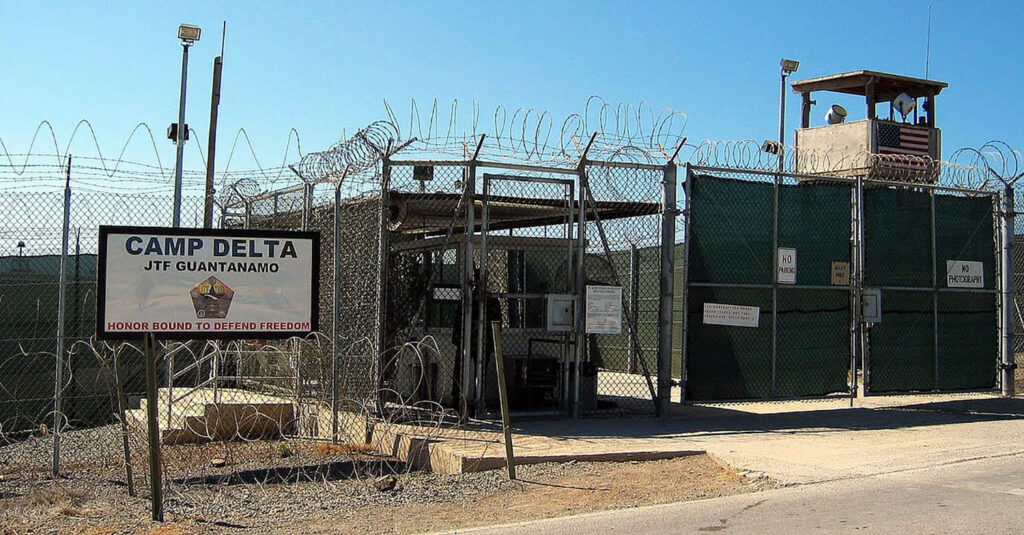

How can Donor-Advised Funds help shut down Guantánamo Bay?

Reprieve has secured more releases from Guantánamo Bay than any other NGO or law firm. A grant from your Donor-Advised Fund can help us secure more releases from Guantánamo Bay for our clients who have been cleared for release but are still waiting to return to their families and rebuild their lives. Reprieve US will advocate for the complete closure of the prison.

Your donation could also support former detainees through our groundbreaking Life After Guantánamo program, the only program in the world to holistically support former Guantánamo detainees after their release.

How can Donor-Advised Funds help abolish the death penalty in the US?

A grant from your Donor-Advised Fund can help us abolish the cruel and inhumane application of the death penalty in the US. With your support, Reprieve US can work to save people from execution – and in doing so, challenge whole systems of injustice.

How can Donor-Advised Funds help abolish the death penalty around the world?

A grant from your Donor-Advised Fund can help us end the death penalty around the world. Reprieve will support the push for abolition in Malawi, help end the death penalty for childhood crimes in Saudi Arabia and end the death penalty for drug offences in Pakistan.

How else can you help Reprieve US?

If you’d like to donate to Reprieve US in another way, you can make a one-off donation. A single case can take us years to resolve. Monthly donations are a great way of supporting those projects on a long-term basis.

If you do not have a Donor-Advised Fund, you can still give to Reprieve US online or send a check to Reprieve US, PO Box 792325, New Orleans, LA, 70179-2325.

When did Donor-Advised Funds start?

Donor-advised funds are booming in popularity, but they are not new. Some of the earliest versions of Donor-Advised Funds started as early as the 1930s. After being formally recognized in the Pension Protection Act of 2006, they are now one of the fastest growing philanthropic vehicles.

The National Philanthropic Trust report that grants from Donor-Advised Funds totaled an estimated $45.74 billion in 2021 alone. This is an increase of 28.2% increase from 2020, which itself was a 28.3% increase on 2019.

Are Donor-Advised Funds tax deductible?

One huge advantage of Donor-Advised Funds is that they are federal income tax deductible. You will receive this benefit immediately when you make a contribution into your Donor-Advised Fund, not when you make the grant recommendation to a charity. In this respect, you can fast-track your tax benefit while you decide who to support.

Tax benefits will depend on your individual circumstances, and we always recommend you consult an accountant or a tax advisor.